In today’s rapidly evolving digital economy, businesses face an array of challenges, with varying degrees of risk. This holds especially true for those operating within high-risk industries. Such industries often grapple with securing reliable payment processing solutions, managing fraudulent activities, and addressing chargeback issues.

Among the prominent players addressing these concerns is Highriskpay.com, a specialized platform offering tailored solutions for high-risk merchants. This comprehensive article delves deep into the intricate world of high-risk merchant accounts, examines the industries they serve, underscores the critical role of specialized providers like Highriskpay.com, and offers an in-depth understanding of their services.

Understanding High Risk Merchant Accounts

High-risk merchant accounts form the cornerstone of financial operations for businesses operating in sectors characterized by elevated risk factors. Industries like adult entertainment, online gambling, travel, e-commerce, and more, fall under this category.

The distinguishing feature of these industries is their high chargeback ratios, susceptibility to fraud, and intricate regulatory landscapes. This makes traditional payment processing solutions challenging to secure, leading to the need for specialized high-risk merchant accounts.

Industries Considered High-Risk

The spectrum of high-risk industries is diverse and spans across various sectors. Adult entertainment, online dating, travel, online gaming, e-cigarettes, firearms, subscription services, and more are classified as high-risk due to the unique challenges they present.

Each of these sectors entails specific risk elements, necessitating tailored payment solutions to ensure smooth financial operations.

The Role of Highriskpay.com

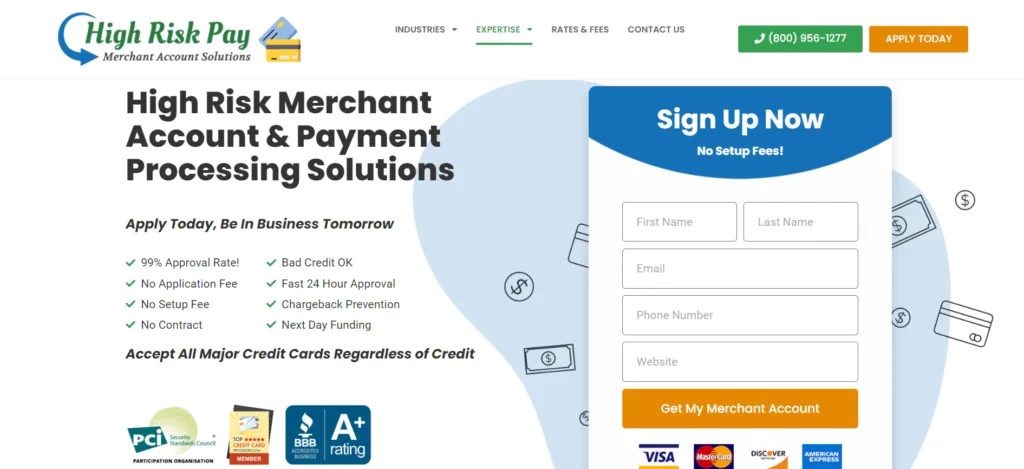

Highriskpay.com, a trailblazer in the high-risk merchant account realm, was established in 1997. This platform specializes in offering offshore and high-risk merchant accounts, specifically designed to cater to businesses confronting intricate financial challenges.

The primary objective of Highriskpay.com is to facilitate seamless business operations by furnishing secure credit card processing solutions at competitive rates.

Benefits of High Risk Merchant Accounts

For businesses entrenched in high-risk industries, access to specialized high-risk merchant accounts is not just an advantage but a necessity. These accounts offer an array of benefits, including advanced chargeback prevention mechanisms, comprehensive fraud mitigation strategies, swift credit card solutions, and industry-specific support.

Highriskpay.com, in conjunction with other reputable providers, zeroes in on the distinctive requirements of high-risk merchants, thereby enabling them to accept payments seamlessly while efficiently managing the inherent risks.

How to Obtain a High Risk Merchant Account

Acquiring a high-risk merchant account is a process that demands meticulous planning and preparation. Leading providers like Highriskpay.com streamline the application process, particularly catering to businesses grappling with bad credit or offshore interests.

Standard documentation requisites typically encompass business registration information, driver’s license, proof of insurance, and a Personal Identification Number (PIN).

Choosing the Right Provider

Selecting an apt high-risk merchant account provider is a pivotal decision that warrants careful consideration. Crucial factors to evaluate include pricing structures, offered features, breadth of industry coverage, quality of customer support, and contractual terms.

Reputed providers such as Highriskpay.com, PaymentCloud, Durango Merchant Services, and Host Merchant Services present holistic solutions tailored to the unique demands of high-risk industries.

The Dynamics of Risk Assessment and Flexibility

In the dynamic landscape of high-risk merchant accounts, the assessment of risk is an ongoing process. The risk profile of a business can evolve over time due to factors such as growth, expansion, or shifts in the industry landscape.

This underscores the importance of having a provider like Highriskpay.com that can adapt to changing circumstances and offer flexible solutions.

Understanding the Fee Structure

High-risk merchant accounts often come with a fee structure that reflects the unique challenges of the industries they serve. While fees can vary, it’s essential to understand the breakdown of costs.

These may include setup fees, transaction fees, chargeback fees, and possibly rolling reserves. Carefully reviewing and comprehending the fee structure is crucial to ensuring transparency and making informed financial decisions.

Ensuring Compliance and Security

High-risk industries often grapple with regulatory complexities and security concerns. High-risk merchant account providers like Highriskpay.com prioritize compliance with industry standards and regulations.

They implement robust security measures to safeguard sensitive customer data, mitigate fraud risks, and ensure a secure and seamless payment processing experience.

Conclusion: Navigating the High-Risk Landscape

In the ever-changing landscape of commerce, businesses operating in high-risk industries face distinctive challenges that demand tailored solutions. High-risk merchant accounts, like those offered by Highriskpay.com, play a pivotal role in enabling these businesses to navigate the complexities of their industries.

By providing specialized payment processing, robust fraud prevention, and industry-specific support, these accounts empower high-risk merchants to thrive in their respective sectors while effectively managing risks.

As technology and industry landscapes continue to evolve, the significance of high-risk merchant accounts and dedicated providers remains unwavering, ensuring that businesses can navigate the high-risk landscape with confidence and success.

Frequently Asked Questions

What is a high-risk merchant account, and why do some businesses need it?

A high-risk merchant account is a specialized financial service designed for businesses operating in industries prone to higher chargebacks and fraud. Industries like adult entertainment, online gaming, and travel often fall into this category. High-risk merchant accounts offer tailored solutions to help these businesses process payments while managing the unique risks associated with their industry.

How does Highriskpay.com differ from traditional payment processors?

Highriskpay.com specializes in providing high-risk merchant accounts, catering to businesses that may struggle to secure payment processing through traditional providers. Unlike conventional processors, Highriskpay.com offers solutions tailored to the specific needs of high-risk industries, such as enhanced fraud prevention and chargeback management.

What are the key benefits of using Highriskpay.com for a high-risk merchant account?

Highriskpay.com offers several benefits, including specialized support for high-risk industries, advanced chargeback prevention measures, quick credit card processing solutions, and competitive rates. The platform’s expertise lies in navigating the complexities of high-risk businesses, ensuring seamless financial operations even in challenging sectors.

Are there specific industries that Highriskpay.com serves?

Yes, Highriskpay.com caters to a range of high-risk industries, including adult entertainment, online dating, travel, online gaming, firearms, and more. These industries face unique challenges, and Highriskpay.com provides tailored payment solutions to help them operate efficiently and securely.

What factors should I consider when choosing a high-risk merchant account provider like Highriskpay.com?

When selecting a provider, consider factors such as pricing structures, industry coverage, fraud prevention measures, customer support quality, and contractual terms. Reputable providers like Highriskpay.com, PaymentCloud, Durango Merchant Services, and Host Merchant Services offer comprehensive solutions tailored to the needs of high-risk businesses.