A cashier’s check is a secure form of payment that guarantees funds to the recipient. It’s often used for large transactions, such as buying a car or a house. If you need to send a cashier’s check, it’s important to know how to fill it out properly to avoid any issues or delays. In this article, we’ll go over the basics of cashier’s checks and provide a sample to help you understand how to fill one out correctly.

What is a Cashier’s Check?

A cashier’s check is a type of check that is issued by a bank or other financial institution. When you get a cashier’s check, the bank takes the funds from your account and holds them in its own account. The bank then issues a check to the recipient for the amount you requested, guaranteeing that the funds are available.

Why Use a Cashier’s Check?

Cashier’s checks are often used in transactions where a large amount of money is involved. This is because they are considered to be more secure than personal checks, which can bounce if there are insufficient funds in the account. Cashier’s checks are also commonly used when you need to make a payment to someone who doesn’t accept credit cards or other forms of payment.

How to Get a Cashier’s Check?

To get a cashier’s check, you’ll need to go to your bank or credit union. You’ll need to provide the bank with the name of the recipient, the amount of the check, and any other information the bank requires. You’ll also need to pay a fee, which can vary depending on your bank.

How to Fill Out a Cashier’s Check?

To fill out a cashier’s check, you’ll need to:

- Write the name of the recipient in the “Pay to the Order of” field.

- Write the amount of the check in the box provided.

- Sign the check in the bottom right-hand corner.

- Write any notes or comments in the memo field, if desired.

It’s important to make sure that you fill out the check correctly to avoid any delays or issues with the transaction.

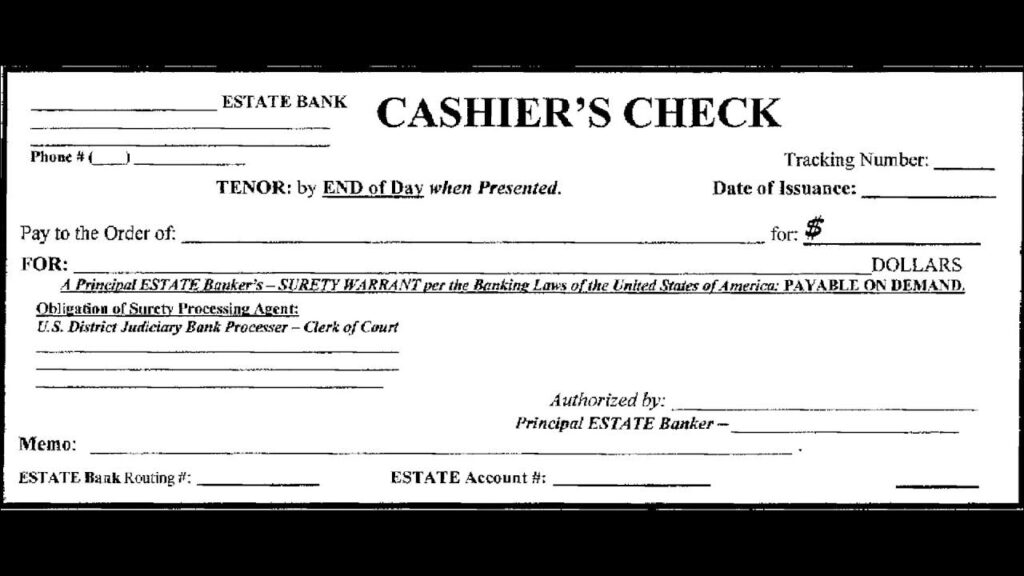

Cashier Check Sample

Here is a sample of how to fill out a cashier’s check:

Pay to the Order of: John Smith $1,000.00 Memo: Car Payment

Signature: [Your Signature]

Make sure that you double-check the information on the check before you send it to ensure that there are no errors. Keep a copy of the check for your records.

Conclusion

A cashier’s check is a secure form of payment that guarantees funds to the recipient. If you need to send a cashier’s check, it’s important to know how to fill it out properly to avoid any issues or delays. By following the steps outlined in this article and using the sample provided, you can ensure that your transaction goes smoothly and securely.

FAQs About Cashier’s Check

What is a cashier’s check?

A cashier’s check is a type of check that is guaranteed by the bank that issued it. This means that the funds for the check are already available, so it is less likely to bounce than a personal check. Cashier’s checks are often used for large transactions, such as buying a car or a house.

How do I get a cashier’s check?

To get a cashier’s check, you will need to go to your bank or credit union. You will need to provide the bank with the name of the recipient, the amount of the check, and any other information the bank requires. You will also need to pay a fee, which can vary depending on your bank.

How do I fill out a cashier’s check?

To fill out a cashier’s check, you will need to:

- Write the name of the recipient in the “Pay to the Order Of” field.

- Write the amount of the check in the box provided.

- Sign the check in the bottom right-hand corner.

- Write any notes or comments in the memo field, if desired.

What are the benefits of using a cashier’s check?

There are several benefits to using a cashier’s check, including:

- Cashier’s checks are guaranteed by the bank, so they are less likely to bounce than personal checks.

- Cashier’s checks are a more secure form of payment than cash, as they cannot be lost or stolen.

- Cashier’s checks are often accepted as payment for large purchases, such as cars or houses.

What are the drawbacks of using a cashier’s check?

The main drawback of using a cashier’s check is that it can be more expensive than other forms of payment, such as cash or a personal check. Additionally, cashier’s checks can take some time to process, so they may not be the best option if you need to make a payment quickly.